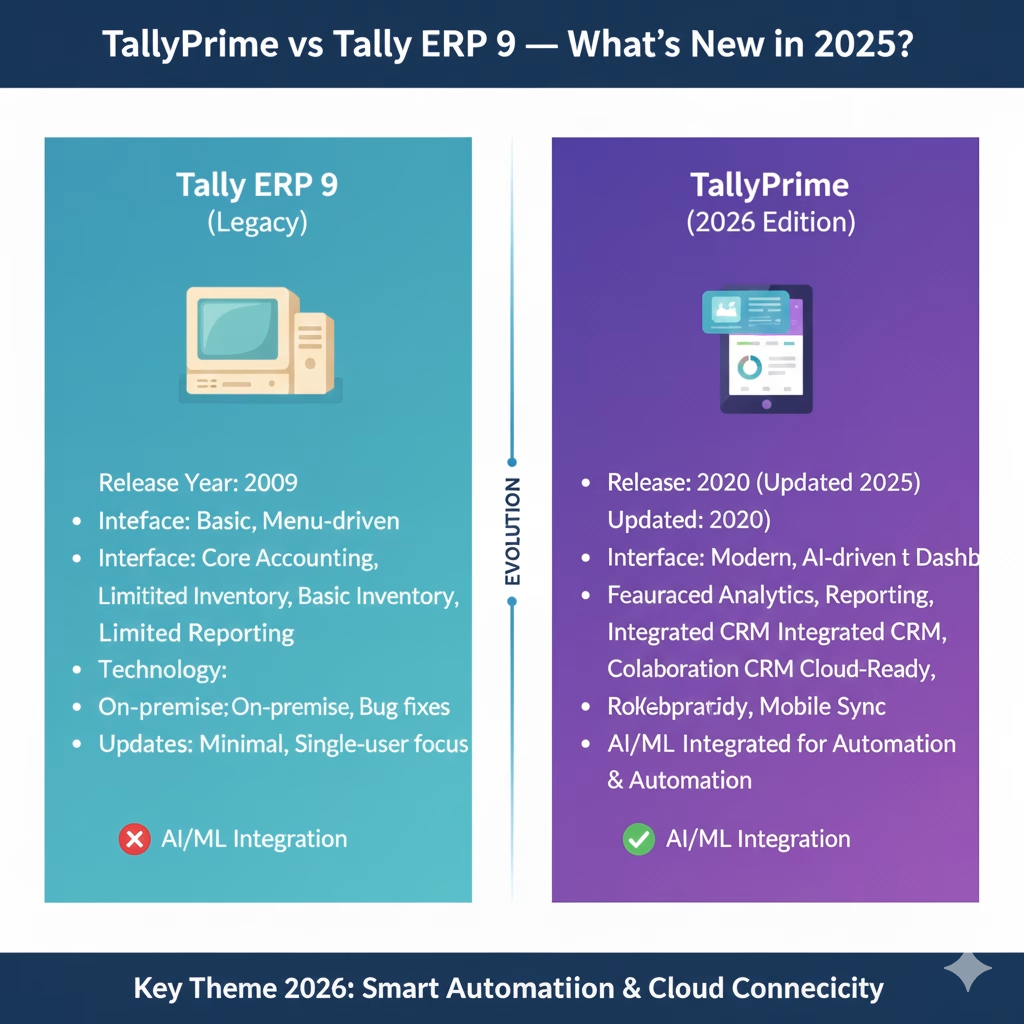

TallyPrime vs Tally ERP 9 — What’s New in 2025?

In the world of Indian accounting and small business software, Tally ERP 9 was long the standard. But with continuous updates to TallyPrime, many users are wondering: Which is better now, in 2025? What new features does TallyPrime offer that ERP 9 lacks? And should you upgrade (or learn TallyPrime) now?

This article explores those questions in depth.

1. A Quick Recap: Tally ERP 9 & TallyPrime

- Tally ERP 9: The older “classic” version, widely used for accounting, inventory, GST and compliance tasks. Over time, it received GST and invoicing modules, but its architecture and interface are more dated.

- TallyPrime: The modern successor to ERP 9, designed with improved usability, better navigation, enhanced compliance features, and newer modules. It’s positioned as the future-proof version. (Tallystack)

As software evolves, TallyPrime has seen newer versions — in 2024–2025, versions 6.0 and 6.1 are particularly relevant, bringing powerful updates. (TallyPrime)

2. Key Differences: What TallyPrime Adds Over ERP 9

Here are the major enhancements and changes that make TallyPrime more compelling in 2025, especially compared to ERP 9:

| Feature / Capability | Tally ERP 9 | TallyPrime (2025) | Why It Matters |

|---|---|---|---|

| User Interface & Navigation | More rigid menus, less flexible | Cleaner, more intuitive, “Go To” feature (Alt+G shortcut) (TallyPrime) | Faster navigation, less learning curve |

| Multi-tasking / Multiple Windows | Limited switching between screens | Supports opening several reports and screens at once without losing context (TallyPrime) | Improves productivity for accountants |

| Banking & Reconciliation | Standard BRS, manual imports | Automated bank statement import, smart reconciliation, connected banking (Easy Reports) | Saves time, reduces errors |

| Invoice & GST Features | Basic GST, e-invoicing handled separately | Invoice Management System (IMS) — auto-import & match GST invoices (GSTR-2B etc) (TallyPrime) | Ensures correct ITC / input credit, reduces mismatch risk |

| Edit Log / Audit Trail | Basic logging | Enhanced edit log with comparison views, user-based filters (TallyPrime) | Better for audits, data security |

| MSME / Statutory Compliance | Limited or manual reporting | Dedicated MSME vendor classification, automated vendor payment disclosure, late payment flags etc (TallyPrime) | Helps businesses stay compliant with new regulations |

| Data Handling & Performance | May slow down with large datasets | Better optimization, faster startup & report generation (spectracompunet.com) | Scales better for growing business |

| Data Split & Verification | Manual splitting of company data | Improved “Data Split” with enhanced validation & progress tracking (TallyHelp) | Better for large or multi-year data |

| GST / HSN Summary Updates | Older formats, manual workarounds | Support for HSN summary breakups for B2B/B2C for 2025 mandates (TallyHelp) | Aligns with GSTN’s evolving rules |

| Offline / Remote Access | Mostly on local machines, complex remote setups | Improved remote access / cloud-hosting compatibility (Techjockey) | Work from anywhere, more flexibility |

| Compliance Updates | Slower updates for new tax rules | Quicker adaptation to regulatory changes (GST, audit rules) (TallyPrime) | Helps avoid fines or mistakes |

3. What’s New in TallyPrime 6.0 & 6.1 (2024–2025 Updates)

To see what sets TallyPrime apart in 2025, here are some of the most recent and relevant upgrades:

a) Invoice Management System (IMS)

One of the flagship features in version 6.1 — this module lets users import invoices from the GST portal (like GSTR-2B), match them with your books, mark them as “matched / mismatched,” and manage action tags (accepted, rejected etc.) directly in software. (TallyPrime)

This streamlines the reconciliation of inward supplies and reduces mismatch issues.

b) Enhanced Edit Log / Audit Trail

Changes in masters and vouchers can now be compared side-by-side, filtered by user, and summarized. (TallyPrime)

This is especially useful for auditing, internal controls, and accountability.

c) MSME Vendor Reporting / Compliance

TallyPrime 6.1 supports automatic classification of MSME vendors, generating annexures (Form MSME-1) with vendor-wise due details, flagging late payments, and exporting to Excel for regulatory submissions. (TallyPrime)

d) Banking & Reconciliation Enhancements

- Improved carry-over of unreconciled items post data-split (TallyPrime)

- Auto-suggestions when matching bank transactions (spectracompunet.com)

- Import payment status files & show statuses like ‘Accepted / Failed / Pending’ (TallyPrime)

e) GST & HSN Updates

- Support for breakup of HSN summary between B2B and B2C in GSTR-1 from new rules in 2025 (TallyHelp)

- Recalculation of GSTR-2B impact based on invoice matching in IMS (TallyPrime)

- More flexible export formats for GST forms (CSV, XLSX) for convenience (spectracompunet.com)

f) Performance & Usability Enhancements

- Faster opening of screens and reports

- Better optimization during data split, error checking

- UI tweaks, smoother navigation, improved stability (TallyPrime)

g) Other Features

- Profile management: update contact details tied to your Tally serial number inside the application. (TallyHelp)

- Tolerance levels for minor invoice mismatches (e.g. small rounding differences) in IMS. (TallyPrime)

4. Should You Upgrade or Learn TallyPrime in 2025?

Here are some considerations to decide whether TallyPrime is the right future choice:

✅ Why upgrade or switch to TallyPrime?

- You want better efficiency & speed in accounting tasks

- You handle GST, input credit, invoice reconciliation regularly

- You seek improved audit trails, compliance, and transparency

- You wish to learn skills that will be future-ready for employers

- You deal with banking integration or remote access needs

🚧 Possible reasons to stay with ERP 9 (for now)

- You have legacy customizations or modules that are tightly coupled with ERP 9

- Your business is small and your accounting needs are minimal (with low growth plans)

- The cost or effort of migration, data split, or re-learning is currently a barrier

However, given current trends and regulatory demands (GST, audit, compliance), knowing TallyPrime in 2025 and beyond is more beneficial, especially for accounting students, business owners, freelancers, and professionals.

5. How This Impacts Someone Taking a TallyPrime Course

If you’re creating or promoting a TallyPrime course, you can use this comparison article to highlight:

- Real, up-to-date features only present in TallyPrime (IMS, edit logs, MSME compliance)

- Why learning TallyPrime gives an advantage over old ERP 9 knowledge

- The future-readiness of TallyPrime skills in accounting jobs

- Use the article to internally link to your course page: e.g. “Enroll now in the latest TallyPrime course to master all these modern features.”

6. SEO & Keyword Tips

To maximize the SEO potential of this article:

- Use your target phrase “TallyPrime vs Tally ERP 9” (and variations) in:

- Title / H1

- First 100 words

- Subheadings & alt texts

- URL (e.g.

/tallyprime-vs-tally-erp9-2025) - Use long-tail versions like: “What’s new in TallyPrime 6.0 / 6.1 vs ERP9”, “TallyERP9 to TallyPrime upgrade 2025”, etc.

- Use internal links to your TallyPrime course and certificate pages

- Use schema markup (

Articleschema) and allow Google to show rich snippets - Add images or infographics comparing features, with optimized alt text (e.g. “TallyPrime vs ERP9 interface comparison 2025”)

- Promote this article via your social media, WhatsApp groups, forums, and ask students to share — helps bring backlinks and traffic

If you like, I can tailor this article for your website (tallysense.in) with subtle internal links and branding, and send you the ready-to-publish HTML version. Want me to do that?