Zero to Hero with TallyPrime in 45 Days!

New Batch Starting From 3 Oct 2025

4.9 Rating

Learn TallyPrime

Start your career in accounting with confidence. Learn TallyPrime from scratch with real-world business scenarios, assignments, and lifetime access to recordings.

घर बैठकर एकाउंटिंग सीखें ! और टैली में मास्टरी करें !

Master Tally from the Comfort of Your Home!

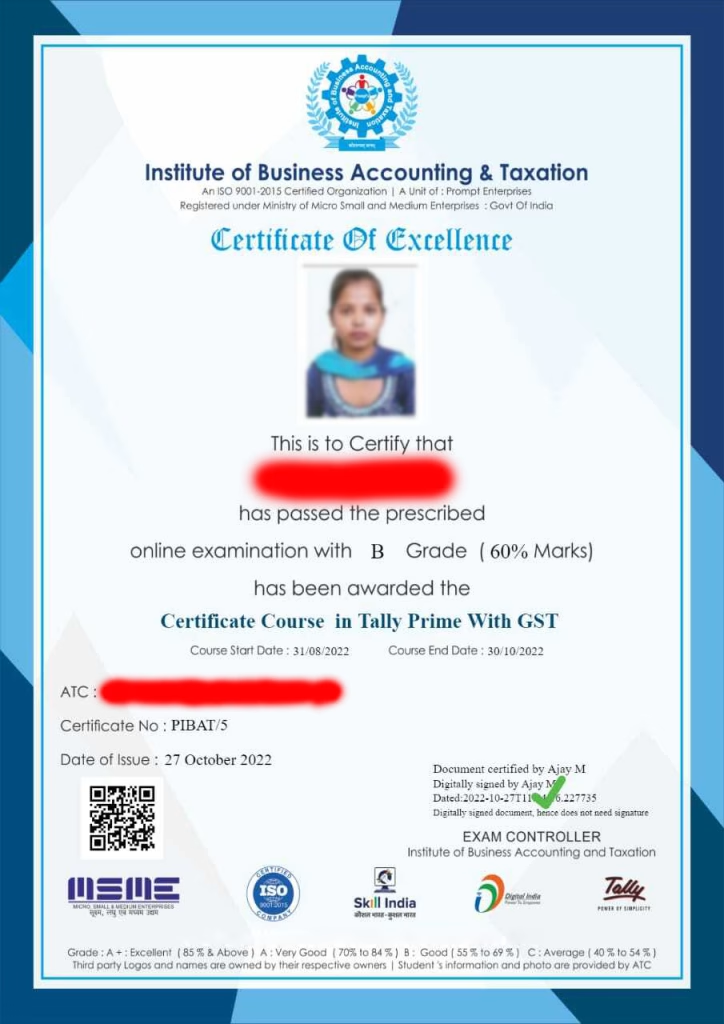

Get Help to Earn Tally Certification.*

![]() By Kushal Agrwal

By Kushal Agrwal ![]() In Hindi

In Hindi ![]() 45 Days Live Class

45 Days Live Class

हिंदी Language

Live

Training

Daily

Recording

Just

₹ 999/-

improve your skill

Tally Certification

Tally certification can help you improve your accounting skills and career prospects in finance.

Tally certification can help you learn how to use Tally software effectively to cover topics such as accounting, billing, payroll, taxation, and inventory management.

main features

It will give you an excellent opportunity for you if you are applying for a job in the field of Accounting.

- Be Skilled

- Training

- Be Job Ready

- Mock Test

- Online Exam

- Certificate

Certificate will be charged 399/- Extra!

Why Online

Course?

Tally is the only Skill that make you job ready just in 45 Days. GST Tax reform increased Tally workforce opportunities in the last few years.

Why Choose Us?

- Fees - ₹999/-

- Duration - 45 Days

- Time - 9:00 PM

- Language - Hindi

- 3 Free e-Books in Hindi worth ₹1999/-

- Recording - Available

- Assignments & Practice Notes

- QA - Daily

- Weekly Doubt Sessions

What Will you Learn in this Tally Training Program?

A 45-day training program offering daily live classes with a Tally Certified Mentor, designed to enhance your skills in Computer Accounting and increase job opportunities.

Course Curriculum

01 – Download and Install Tally Prime

02 – Create Company in Tally

03 – Tally Prime Alter Company Data

04 – Tally Vault Password

05 – Tally Company Configuration

01 – Tally Create Users & Security

02 – View Tally Reports in Mobile / Browser

03 – What is Accounting

04 – What is Financial year

05 – Create and Alter and Delete Group

06 – Create Ledgers In Tally Prime 4

07 – Create Multiple Ledgers In Tally Prime 4 Min

08 – Different Ledgers And Their Meanings In Tally 4

01 – Business First Voucher Entry In Tally 1

02 – Receipt Voucher Goods Sold On Cash 1

03 – Receipt Voucher Amount Received In Cheque

04 – Receipt Voucher Amount Received In Cash 1

05 – Contra Voucher 1

06 – Contra Voucher 2

07 – Payment Voucher 1

08 – Payment Voucher 2

09 – Purchase Voucher

10 – Sales Voucher

11 – After Puchase Sales

12 – After Sales

01 – Adjustment Entries 1

02 – Adjustment Entries 2

03 – Purchase Return and Sales Return

04 – Assignment on Voucher Entries 1

05 – Assignment on Vouhcer Entries 2

06 – Assignment on Vouhcer Entries 3

07 – What Is Accounting Cycle 1

08 – What Is Balance Sheet 1

01 – Stock Entries 1

02 – Stock Entries 2

03 – Stock Entries 3

04 – Stock Entries 4

05 – Cost Centers Introduction 1

06 – Cost Centers Hide Details

07 – Cost Centers Example 1

08 – Cost Centers Example – 2

09 – Keyboard Shortcuts

10 – Multiple Stock Item Entries

11 – Stock Transfer Stock Journal Vouchers

12 – Physical Stock Voucher

01 – Organization Types

02 – Trading Organization Accounting

03 – Purchase Order

04 – Receipt Note Voucher

05 – Rejection Out Voucher

06 – Purchase Invoice

07 – Debit Note Purchase Return

08 – Sales Order

09 – Delivery Note

10 – Rejection In

11 – Create Sales Bill

12 – Credit Note Sales Return 1

01 – Create Sales Bill 1

02 – Credit Note Sales Return 1

03 – TDS Introduction

04 – TDS Introduction

05 – TDS on Interest

06 – TDS Introduction

07 – TDS Entry in Tally

08 – TDS Adjustment

09 – What is TDS Certificate

10 – Before Practice on TDS Important Instruction

11 – TDS Related Questions

12 – TDS Entry as a Deductor 1

13 – TDS Entry as a Deductor 2

14 – TDS Entry as a Deductor 3

15 – TDS Entry as a Deductor 4

16 – TDS Payment

01 – GST Introduction

02 – SGST, CGST and IGST Terms

03 – GST What is HSN and SAC

04 – What is Regular Dealer and Composition

05 – Create Purchase Invoice Intrastate GST

06 – Create Purchase Invoice Interstate GST

07 – Check Stock and Purchase Register

08 – Create Sales Invoice Intrastate GST

09 – Create Sales Invoice Interstate GST

10 – Check Sales Register and Stock Summery

11 – GSTR1, GSTR2, GSTR3B

12 – What is E Way Bill

13 – Genterate JSON of E Way Bill

01 – Purchase RAW Material

02 – Create BOM Bill of Material

03 – Create Manufacturing Journal

04 – Sold Finish Goods

01 – Introduction of Service Organization

02 – Introduce Capital in Service Sector

03 – Purchased Fixed Assets with GST Invoice

04 – Purchased Stationery with GST Invoice

05 – Puchased Computers GST Invoice

06 – Taken Advertisement Service

07 – Provide Service and Received Payment 1

08 – Provide Service and Received Payment 2

09 – Sales Services and Received Payment 3

10 – View Reports of Service Sectors

01 – Tally Prime Features VS Tally ERP

02 – Customize Sales Invoice Number

03 – Compound Unit and Alternate Unit

04 – Backup and Restore DATA

05 – Import and Export

06 – Export data in Excel

01 – Payroll Introduction 1

02 – Create Employee Record 1

03 – Create Work Unit 1

04 – Create Earning Payhead 1

05 – Create Earning Payhead 2

06 – Create Deduction Payhead 1

07 – Define Salary Structure 1

08 – Create Payroll Voucher 1

1 – GST Filing – GST Registration Process

2 – GST Filing – Export Data in CSV from Tally

3 – GST Filing – Create JSON File with GST Offline tool

4 – GST Filing – Filing GSTR1 Sales on GST Portal

5 – GST Filing – Making Payment on GST Portal Filining GSTR3B

1 – TCS – What is TCS?

2 – TCS – Practical Entry in Tally Prime

3 – TCS – Payment Entry’s

1 – BRS In Tally Complete Video

1 – Practice Assignment of Tally Prime

2 – How to Get Tally Certification?

3 – How to Perform Mock Test?

Mr. Kushal is the online course mentor for TallyPrime at TallySense.in. With over 10 years of experience in accounting Practice using Tally, he is a certified expert who knows how to make complex concepts easy to understand. Mr. Kushal’s teaching style is engaging and practical, focusing on real-world applications of TallyPrime. He provides personalized support to each student, ensuring they grasp every aspect of the software. His goal is to help learners become proficient in TallyPrime, enhancing their skills and job opportunities in the accounting field.

Join the class to master TallyPrime with confidence.

Meet The Coach

M.Com. L.L.B. (Tax) Tally Certified

"Master TallyPrime in 45 Days – Unlock Your Dream Job with Expert Guidance!"

₹ 5999/-

₹ 999/-

Join Today ! & Get 3 TallyPrime eBooks in Hindi.

TallySense.in is the online learning platform of Msinfologix, an Authorized Tally Institute of Learning recognized by Tally Education Pvt. Ltd. for over nine years. It offers a 45-day training program with daily live classes led by Tally Certified Mentors. This program helps you develop skills in computer accounting and boosts your job opportunities. The course includes practical exercises and real-world scenarios, providing a hands-on learning experience. With personalized mentor support, TallySense.in ensures you learn at your own pace. Join TallySense.in to advance your career in accounting and finance.

Enjoy a 3-Day Money-Back Guarantee*—No risks, just rewards!

*Only Payment Gateway Charge Rs-30 deducted